Quick Links

Favorites

Customize ESPN

ESPN Sites

ESPN Apps

Follow live: Man City seek to close gap on Arsenal

TOP HEADLINES

GLOBAL SOCCER SCOREBOARD

SATURDAY'S GAMES

Ipswich fans storm the pitch to celebrate return to Premier League

Ed Sheeran celebrates Ipswich's promotion

MUNICH STUNNED BY STUTTGART

Stuttgart shock Bayern Munich in 3-1 win

Harry Kane scores from the penalty spot for Bayern Munich

Bellingham doubles Real Madrid's advantage vs. Cadiz

Brahim Díaz scores stunner to open the scoring for Real Madrid

DRIVING A TITLE CHARGE

Havertz, Rice epitomize Arsenal's progress in Bournemouth win

Declan Rice got a goal and an assist, and Kai Havertz won a penalty, as Arsenal's summer signings continue to drive the title charge.

ASSESSING AMERICA'S BEST

Ranking the top 50 USMNT players on club form: ESPN's Player Performance Index returns

The USMNT Player Performance Index returns to rank the top 50 U.S. national team players and scientifically rate their club form.

How McKennie became one of Serie A's best players

After a nightmarish spell in England, Weston McKennie has found form and confidence again at Juventus.

SOCCER TRANSFERS

LIVE Transfer Talk: Arsenal have Isak on their summer wishlist

Arsenal are looking at Newcastle United's Alexander Isak as their main priority for the summer transfer window. Transfer Talk has the latest.

U.S. SOCCER SCOREBOARD

SATURDAY'S GAMES

Top Headlines

- Madrid ease past Cádiz to edge closer to title

- Brady's Birmingham relegated from Championship

- 'Tastes like promotion': Sheeran hails Ipswich win

- Bayern slump to loss at Stuttgart as Madrid await

- Rice stars as Arsenal win to maintain PL title bid

- Ipswich win to complete shock promotion to Prem

- Outgoing Reus scores in Dortmund's UCL warm-up

- Martino: Miami not in position to sign Di María

- How Liverpool chose Slot as next coach

Best of ESPN+

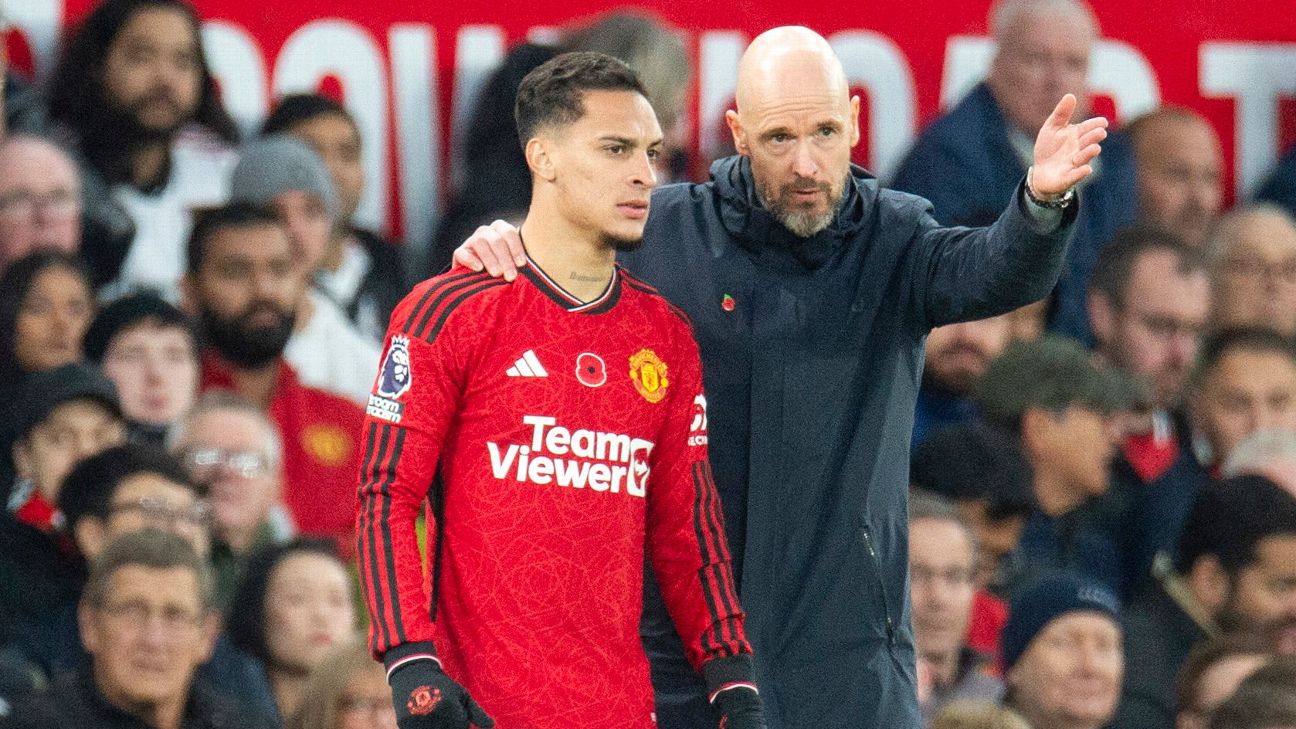

Peter Powell/EPA Ranking all 16 Man United player signings under Erik ten Hag

Man United spent more on players than all but two clubs in the world under Ten Hag, but the team still isn't good. Let's go through all 16 signings to figure out why.

JOSEP LAGO/AFP via Getty Images Can Barcelona ever close the gap to Clasico rivals, Real Madrid?

Last season, Barcelona won LaLiga over Real Madrid by a considerable margin; this season, the tables have turned dramatically. With Barca suddenly in crisis, what would it take for them to catch up?

Trending Now

Colin McPherson/Corbis via Getty Images Football's climate change threat: Flooded stadiums, too hot to train

One in four stadiums in England are predicted to experience flooding by 2050. What is soccer's environmental impact and what can be done to reduce it?

Donald Page/Getty Images Messi tracker: Inter Miami games, goals, assists, more stats

Lionel Messi is in first full season with MLS side Inter Miami. Here's game-by-game analysis of how the World Cup winner is performing for his team.

Tables, fixtures and scores

Photo by James Gill - Danehouse/Getty Images League tables

Updated tables from the Premier League, Champions League, LaLiga, English Football League and more.

Photo by Andrew Kearns - CameraSport via Getty Images Upcoming fixtures

Keep track of all the important upcoming fixtures for all the clubs and countries in world football here.

Guillermo Martinez/SOPA Images/LightRocket via Getty Images Latest scores

Results and scores from the Premier League, Champions League, LaLiga, English Football League and more.