Quick Links

Favorites

Customize ESPN

ESPN Sites

ESPN Apps

How is Bayer Leverkusen's 48-game unbeaten streak even possible? Crunching the numbers

No one has been able to stop Bayer Leverkusen -- no one in Germany and no one in Europe. How is a 48-game unbeaten streak even possible, and can other teams replicate it?

TOP HEADLINES

Is Kylian Mbappe's PSG legacy on the line vs. Dortmund?

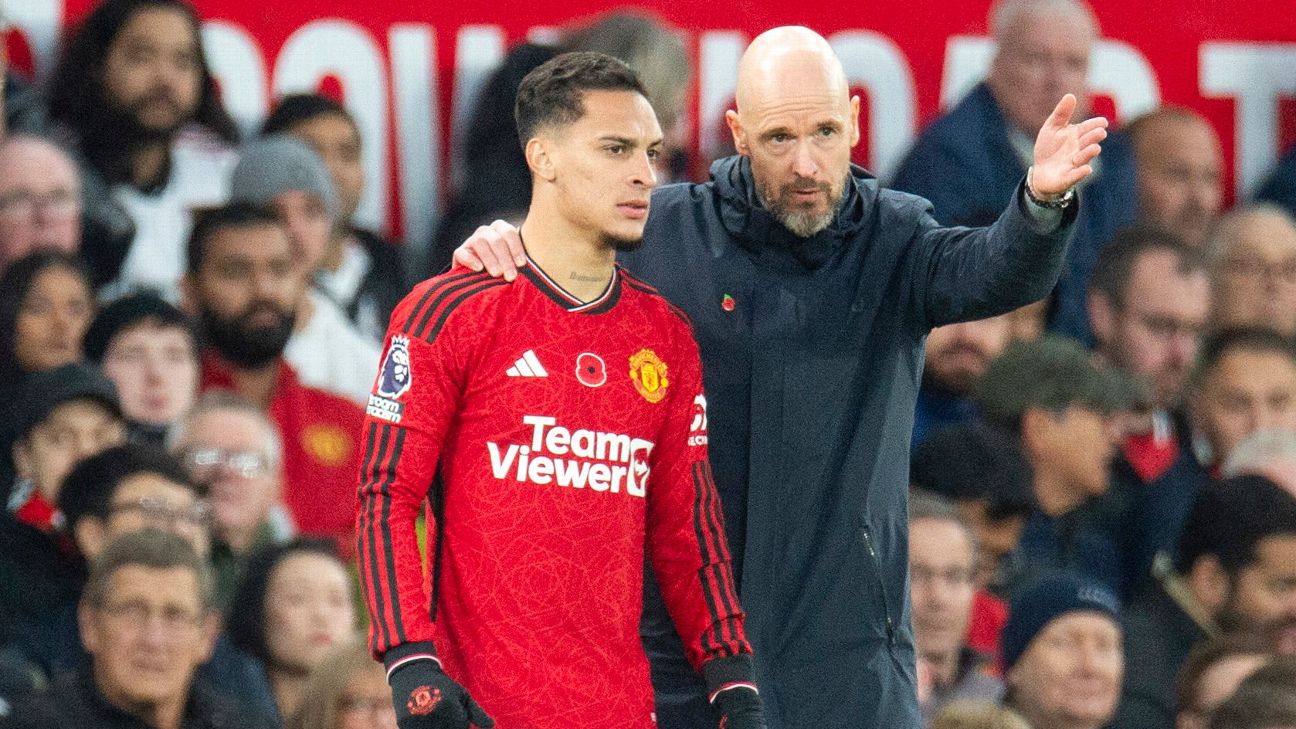

Awful display at Palace all but dooms Man United to worst Premier League season

Manchester United endured a 4-0 loss at the hands of Crystal Palace as Erik ten Hag's side are nearing what could be their worst ever finish in Premier League history.

What are Manchester United's options after Erik ten Hag?

SOCCER TRANSFERS

LIVE Transfer Talk: Arsenal, Man United losing Guirassy race

Stuttgart striker Serhou Guirassy will likely favour a move to Dortmund over Arsenal and Manchester United. Transfer Talk is LIVE with the latest.

Will Mo Salah stay at Liverpool this summer?

Madrid vs. Bayern is a battle of extreme coaching styles. Who will prevail?

Only one of Bayern Munich's Thomas Tuchel and Real Madrid's Carlo Ancelotti -- polar opposites as managers -- can make the Champions League final.

U.S. OPEN CUP AT A CROSSROADS

What lies ahead for America's oldest tournament?

With only eight MLS teams competing in this year's tournament, the future of the U.S. Open Cup remains uncertain.

TOP PERFORMERS

European Team of the Week: Haaland, Jackson, Olise star

ESPN and WhoScored bring you the best players from Europe's top five leagues from the latest round of action.

PREMIER LEAGUE ON COURSE TO BREAK HAT TRICK RECORD

Ranking the Premier League seasons with the most hat tricks

We've seen a lot of hat tricks in this Premier League season thanks to stars like Erling Haaland and Cole Palmer, and the all-time record is in sight.

INTER MIAMI'S STRONG START

LEADS MLS WITH 7 WINS, 24 POINTS

Can any team in MLS compete with Messi & Inter Miami?

Top Headlines

- Maradona's stolen '86 Golden Ball to be auctioned

- J.J. Watt vs. McAfee part of TST soccer tourney

- Chelsea veteran Thiago Silva to rejoin Fluminense

- Sources: Madrid to get trophy behind closed doors

- Greenwood won't return to Man Utd - Getafe chief

- Brazil postpones league matches due to floods

- Nottingham Forest point deduction appeal rejected

- Mbappé confident of PSG reaching UCL final

- Ranking the top 50 American players

Best of ESPN+

Dennis Bresser/Soccrates/Getty Images How Liverpool's data decided Arne Slot should replace Klopp

With Klopp leaving, Liverpool must replace an irreplaceable coach. They've landed on Arne Slot, and digging into the data explains why.

Peter Powell/EPA Ranking all 16 Man United player signings under Erik ten Hag

Man United spent more on players than all but two clubs in the world under Ten Hag, but the team still isn't good. Let's go through all 16 signings to figure out why.

Trending Now

Colin McPherson/Corbis via Getty Images Football's climate change threat: Flooded stadiums, too hot to train

One in four stadiums in England are predicted to experience flooding by 2050. What is soccer's environmental impact and what can be done to reduce it?

Donald Page/Getty Images Messi tracker: Inter Miami games, goals, assists, more stats

Lionel Messi is in first full season with MLS side Inter Miami. Here's game-by-game analysis of how the World Cup winner is performing for his team.

Tables, fixtures and scores

Photo by James Gill - Danehouse/Getty Images League tables

Updated tables from the Premier League, Champions League, LaLiga, English Football League and more.

Photo by Andrew Kearns - CameraSport via Getty Images Upcoming fixtures

Keep track of all the important upcoming fixtures for all the clubs and countries in world football here.

Guillermo Martinez/SOPA Images/LightRocket via Getty Images Latest scores

Results and scores from the Premier League, Champions League, LaLiga, English Football League and more.